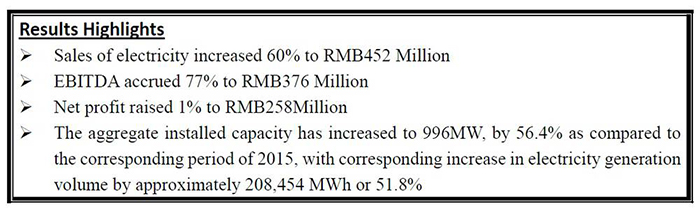

(30 August 2016 – Hong Kong) The United Photovoltaics Group Limited (“United PV” or the “Company”, together with its subsidiaries referred to as the “Group”, stock code: 00686.HK, whose largest shareholder is China Merchants New Energy Group Limited “CMNE”), a leading solar power plant investor and operator in China, is pleased to announce the unaudited condensed consolidated interim results of the Company and its subsidiaries for the six months ended 30 June 2016 (the “Period”). During the Period, the EBITDA of the Company raised 77% to RMB376 million as compared with the same period in year of 2015, sales of electricity accrued 60% to RMB452 million, and the net profit kept stable, amounted to RMB258 million.

Well Operation of Existing Plants, Layout Adjustment on Target Projects

During the Period, the aggregate installed capacity has increased to 996MW, by 56.4%. All plants have achieved on-grid connection and have been generating electricity steadily. The large-scaled solar power plants owned by the Group are mainly located in Inner Mongolia, Qinghai, Xinjiang, Gansu, Hubei and Shanxi, other plants located in Jiangsu, Yunnan and Guangdong are distributed roof-top power plants or combined with eco-agricultural infrastructure. In respect of electricity generation volume, the solar power plants located in Inner Mongolia and Qinghai contributed approximately 43.7% and 25.3% of the total electricity generation for the Period respectively.

For the new project increments, the Group adopts acquisition strategy that creates value and improves overall efficiency of our solar asset portfolio. In locating prospective acquisition targets, the Group has been factoring the key factors into its decision-making, such as solar irrigation, local electricity demand and consumption, infrastructure for electricity transmission, feed-in-tariff criteria. With this prudence approach, the Group has been carefully identified solar power plants located in the central, eastern and northern parts of the PRC and avoid increasing investment in regions suffered from severe curtailment. As demonstrated above, measures were taken to mitigate the risk and impact of curtailment for solar power plants facing curtailment issue.

Exploit Top-Runner’s Advantages, be Proactive in Global Cooperation

On 24 June, 2016, the Shanxi Datong National “Top Runner” Project of United PV has successfully connected to gird. According to the electricity generation data, the project is one of the best performing solar power plants among the Top-Runner Program Phase I as it recorded a highest daily generation volume of 633,600KWh. The Group enhanced the strength of self-development and scientific management by developing the Project, which laying down a solid foundation for projects self-development and smart plant operation in the future.

Meanwhile, United PV exploit Top-Runner’s advantages to continually play a synergistic role in the industry, integrating all sectors of resources to actively participate in global cooperation. Initiatives have been taken by the Group to promote the use of green energy that will involve the construction of Panda-shaped Solar Power Plants with joint efforts from the United Nations and other leading enterprises of the solar energy industry in the PRC and United States. Under the Panda-shaped Solar Power Plants program, it is anticipated that the first Panda-shaped Solar Power Plant will be landed in the PRC and more Panda-shaped Solar Power Plants will be constructed in selected areas around the world with G20 members, aiming to provide green energy for sustainable development and combat climate changes.

Broaden Extensive Financing Channels

In terms of financing, the Group continued to raise financing for the acquisition and construction of power plants and has raised approximately RMB1.6 billion through various channels including bank borrowings and finance leasing during the Period. In addition, the Group is also actively seeking re-financing opportunities that may provide the Group with appropriate capital structure to pursue further growth and development, while lowering the finance costs. On 26th August, the Company has completed the issue of convertible bonds to a subsidiary of China Huarong Asset Management Co., Ltd. in the principal amount of US$50 million.

With unremitted efforts from the management of the Company, United PV has gradually become a cross-border platform integrated with new energy and finance that has received recognition and acknowledgement from the capital market in respect of company performance, potential and future development.